by Roland Krainz

Introduction

In recent years, vinyl has become increasingly popular. An almost vanished medium again plays an important role in the music industry.

This paper discusses the supply and demand forces of vinyl LP/EPs on the US market between 1978 and 2015 and highlights important milestones in its lifecycle.

The LP, as we know it today, experienced a long development process until it became the most popular format in the mid-sixties. The peak of profits for the industry occurred in 1978, then slowly decreasing being about half of its size at the end of the ´80s.

This trend continued until the ´90s as CD took over. Thereafter, LPs almost vanished from the market. However, vinyl record sales slowly started to increase again in the late 2000s and occupied a persistent niche in the marketplace.

Vinyl LP/EP – U.S. Market Analysis

This Section will display important milestones in the vinyl record market over the past 40 years. In particular, we will investigate three important issues. First, the impact of changes in demand variables like tastes, increase of income, ageing population, supplementary products and price elasticity of demand will be discussed. Second, an analysis of the supply side, with all its technological developments, will be provided. How those changes influenced the market, i.e., prices and quantities, will be illustrated.

The statistical data used in this study is based on the Recording Industry Association of America (RIAA, 2019)

Supply and Demand in U.S. 1978

In 1978, vinyl record sales were at its peak. With more than 73% market share, vinyl was the most used medium for listening to music followed by tape-based mediums. Because costumers’ choices about the format of owning music was limited to basically two products. Tape based cassettes and the vinyl record. Moreover, in order to be able to consume the music of an artists in point of time, the purchase of vinyl record was the most favored option available. It is assumed that price elasticity of the demand was inelastic. The supply side faced a constant growth since the ´50s. Infrastructure, knowledge and trained workers were on a high, therefore able to easily meet demand. (Record Industry, 2019)

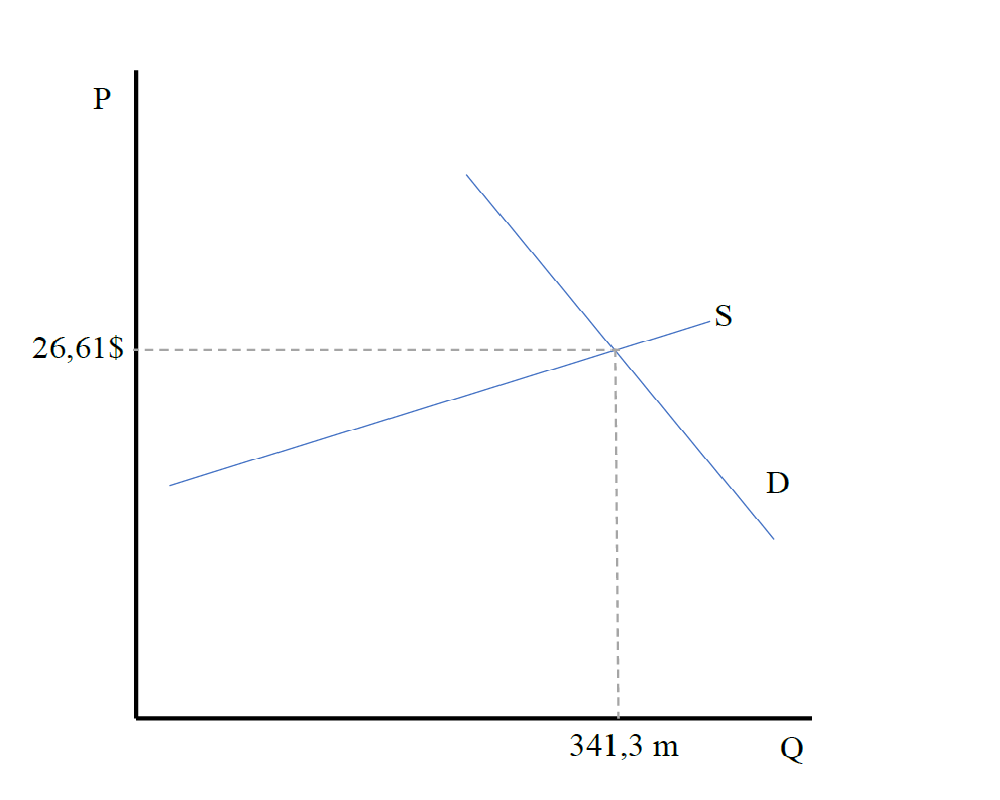

Based on these considerations about demand and supply, we can now model the market and illustrate it in diagram 1. This leads to a market quantity of 341.3 million LP/EPs sold at an average market price of 7.14 US dollars. Because we want to compare prices over a certain time interval, we adjust prices for inflation. Measured in 2015 US-dollars, the market price in 1978 was therefore 26.61 US dollars. (OECD, 2019)

Diagram 1 1978

Supply and Demand in U.S. 1999

In 1999 CD sales were at its peak and vinyl sales on an all-time low since 1978. Record press manufacturers went out of business. (Huet, 2015) In the ´80s, the compact disc became more and more attractive, also because of lower prices and increasing availability of its complementary products, and therefore replaced the vinyl record. (Waniata, 2018) This implies that the demand curve for vinyl shifted to the left. However, given that CDs were a very good substitute, it can be assumed that buyers became more price-elastic. Because a lot of the production capacity of record companies was used for CDs, (Huet, 2015) the supply curve shifted to the left, but also became more inelastic.

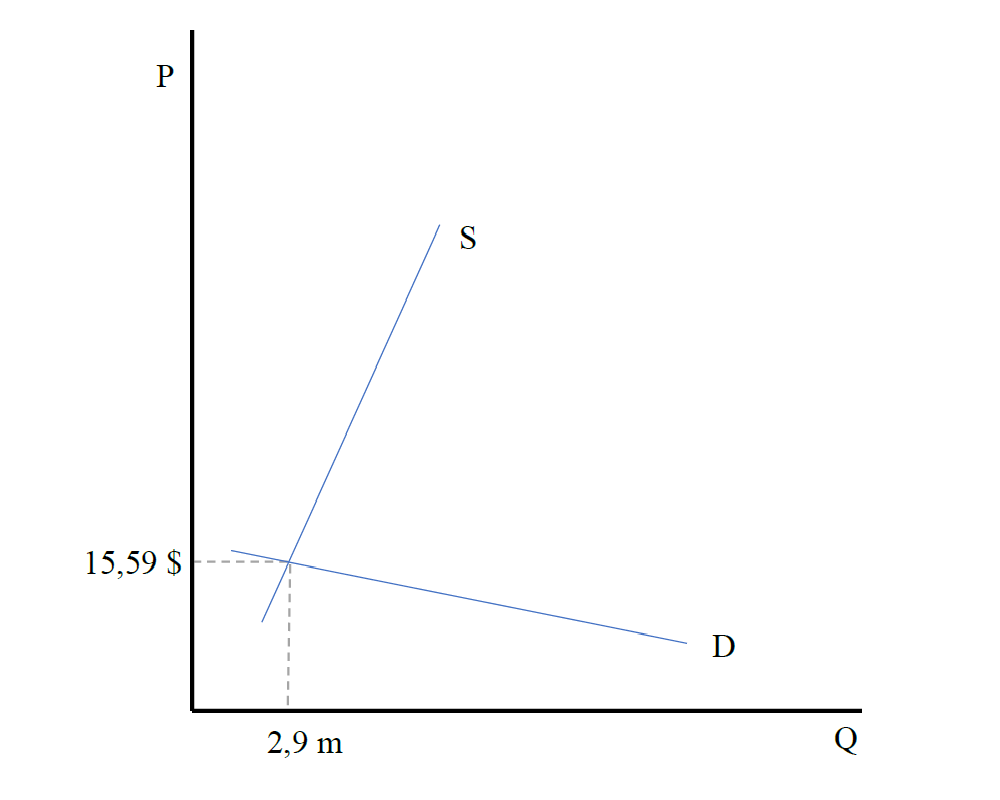

This led to a sharp decrease in sold quantity, which was at an equilibrium level of 2.9 million LP/EP accounting for a total revenue of 31.8 million US dollars. The average market price was at 10.96 US dollars, (RIAA, 2019) measured in current prices which, adjusted for inflation, is 15.59 US dollars in 2015 prices. (OECD, 2019)

Consumer behaviour concerning the consumption of music has changed drastically over the last decade. This is mainly due to the increased importance of downloading and streaming platforms such as iTunes, Spotify or Amazon Music. Although this led to a massive decrease in CD sales, vinyl sales actually experienced a revival. Explanations can be found, for example, in the desire of consumers to own music in physical form, also seeing vinyl as a collector’s item. This is also driven by artists who released albums on vinyl as a haptic counterpart to streaming and download. Awareness to costumers is given via the media emphasizing the peculiarity of the revival. Vinyl is considered to be a premium product with high status.

Diagram 2 1999

Supply and Demand in U.S. 2015

Consumer behaviour concerning the consumption of music has changed drastically over the last decade. This is mainly due to the increased importance of downloading and streaming platforms such as iTunes, Spotify or Amazon Music. Although this led to a massive decrease in CD sales, vinyl sales actually experienced a revival. Explanations can be found, for example, in the desire of consumers to own music in physical form, also seeing vinyl as a collector’s item. This is also driven by artists who released albums on vinyl as a haptic counterpart to streaming and download. Awareness to costumers is given via the media emphasizing the peculiarity of the revival. Vinyl is considered to be a premium product with high status.

That said, we assume the demand curve to be rather price-inelastic with a general shift to the right. On the supply side, given the reduced necessity of capacity for CD production, compared to 1999 there was a shift of the supply curve to the right. The technological progress in the vinyl production was not moved forward. The industry needed special trained workers. (Huet, 2015)

The supply curve is still assumed to be rather inelastic.

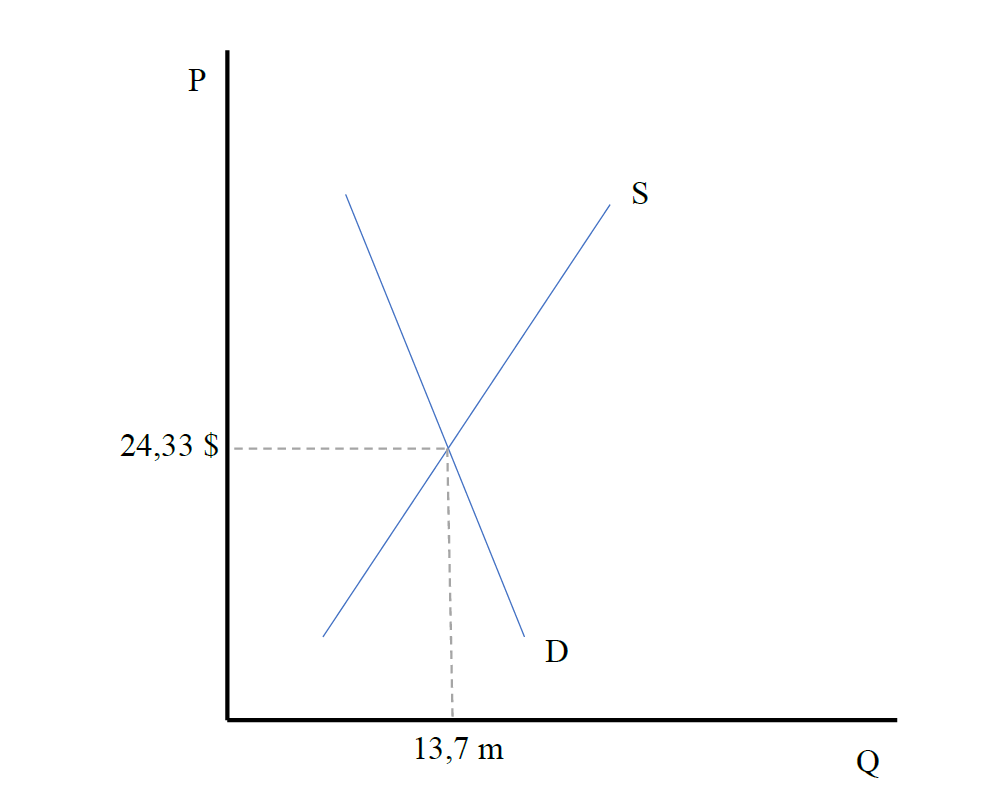

Diagram 3 illustrates the market showing that in equilibrium 13.7 million LP/EPs were sold at an average market price (RIAA, 2019) adjusted for inflation of 24.33 in 2015 US dollars. (OECD, 2019)

Diagram 3 2015

Technological Aspects

This section provides a short overview of the technological process lying behind the production of vinyl, which has a certain impact on the shape of the supply curve. Based on the information on one of the largest vinyl factories in the Word, Rainbo Records California, the increasing demand of vinyl challenges both man and machine.

Most of the work is done by hand. The development of machines, which automated the process, was not pursued due to the falling demand of the format. In order to produce a record, a worker needs around 6 months of training. In comparison, it takes a man about 3 weeks to operate the compact disc pressing process. Because, at least until now, no significant market for new vinyl producing machines has been established, the current demand for vinyl means putting stress on the aging record presses.

Rainbo´s “newest” record press is from 1977, their oldest still in operation from the 50ies. It is foreseeable that increased demand and aging equipment will require new solutions on the part of the production side. (Huet, 2015)

First attempts concerning a change on the supply side have been made by the artist Jack White with his recently opened record production plant, The Third Man Pressing. The factory is equipped with newly built record presses produced by the German company Newbilt. (Third man pressing, 2019)

Newbilt started its business in 2009 by refurbishing old machines and first designed their own machines in 2015. The first factory with solely new built machines started its production in 2016 (Newbilt, 2017)

Hence, even though the technology is there or at least the blueprints of the machines, the process of producing vinyl records is currently rather costly and time and labor intensive. For the near future, this could mean a continuous upward pressure on prices.

Effect on Substitute and Complementary Products

The main complementary product for vinyl is the turntable. Based on statistic data, provided by Statista, sales have not changed significantly during 2005 to 2015. Since 2005 it dropped slightly until 2012 and turned back in 2015 to the same sale figures as in 2005. (Statista, 2017)

On the other hand, Technics discontinued production of their SL-1210 turntable in 2010 due to low demand, but re-activated production again in 2016. (Baurmann, 2017)

However, even this could be interpreted that vinyl can be seen as a luxury commodity. Many high-end boutique manufacturers, as well as exotic materials and sculptural design, underline this assumption.

In the mid-eighties the technologically advanced compact disc, promoted by the industry, was the main factor for the downfall of vinyl. The same accounts for downloading platforms and streaming services, which were significant for the decreasing demand for CDs at the beginning of 2000. (RIAA, 2019)

Interestingly, vinyl demand seems to be less affected by such as music subscription models, indicating that vinyl is considered to be a premium product.

Conclusion

To conclude, at present vinyl record sales is way below those of the mid-nineties but has definitely found its market niche within the music Industry. It is driven by a nostalgic and haptic experience and audiophile enthusiasts who prefer the superior sound characteristics of vinyl to no other medium. The image as collectable item, status symbol, as well as a piece of art makes it a sort of luxury good. The relatively high price of one vinyl disc and the need of multiple complementary products in order to be able to listen to it underline this perception.

For the future this could mean that the demand will remain rather inelastic. Should demand increase further, this might lead to a price increase and higher profits of current record selling companies. This, however, could attract new companies to enter the market.

But this would need a different model to analyze.

Bibliography

Baurmann J. (2017), Zeit Online, in: https://www.zeit.de/2017/10/michiko-ogawa-technicschefin-

japan/komplettansicht , retrieved on 19.02.2019.

Huet E. (2015), Forbes, in: https://www.forbes.com/sites/ellenhuet/2015/07/08/resurgence-invinyl-

records-means-booming-business-and-growing-pains-for-factories/#3491df1ff380 retrieved on 12.02.2019.

Newbilt (2017), For the record NEWBILT machinery, in:

https://newbilt-machinery.com/about/ , retrieved on 19.02.2019.

OECD (2019), OECD Data, in: https://data.oecd.org/price/inflation-cpi.htm , retrieved on 11.02.2019.

Record Industry (2019), Record Industry Europe´s vinyl pressing plant, in:

https://www.recordindustry.com/about-us/ retrieved on 22.02.2019.

RIAA (2019), Recording Industry Association of America, in: https://www.riaa.com/u-s-salesdatabase/ , retrieved on 11.02.2019.

Statista (2019), Statista The Statistics Porta, in:,

https://www.statista.com/statistics/448555/number-of-turntables-sold-in-the-us/ , retrieved on 12.02.2019.

Third man pressing (2019), Third man pressing, in: https://thirdmanpressing.com/about , retrieved on 20.02.2019.

Waniata R. (2018), Digital Trends in: https://www.digitaltrends.com/features/the-history-ofthe- cds-rise-and-fall/ , retrieved on 22.02.2019.